Actuarial Valuation Consulting

Our Services

How we can help you?

We provide risk management and research & development service in insurance and financial risk that include Risk Modeling, Model Implementation (Fund Splitting, Asset Management and Financial Risk), Portfolio Management Review, Insurance & Financial Solutions (Product development, product pricing, distribution channel), offering clients the flexibility to select the best set that caters their needs. Our extensive industry experience coupled with well-developed methodologies, processes and tools, enables us to deliver customized solutions to meet the ever-changing business requirements in the industries. We have access to our network of financial experts and strategic partner.

We are well-positioned to assist insurance companies to set up their actuarial models for financial reporting, business planning, and other reporting requirements. These include:

- GAAP, IFRS and IAS Reporting

- Statutory valuation (e.g., RBC)

- Source of Earnings / Analysis of Profits (AoP)

- New business projection

- Reserving report

- Company-level adjustments

- Hedge attribution analysis

- Appraisal report

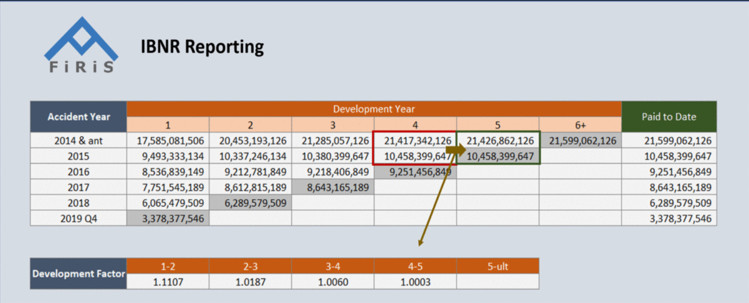

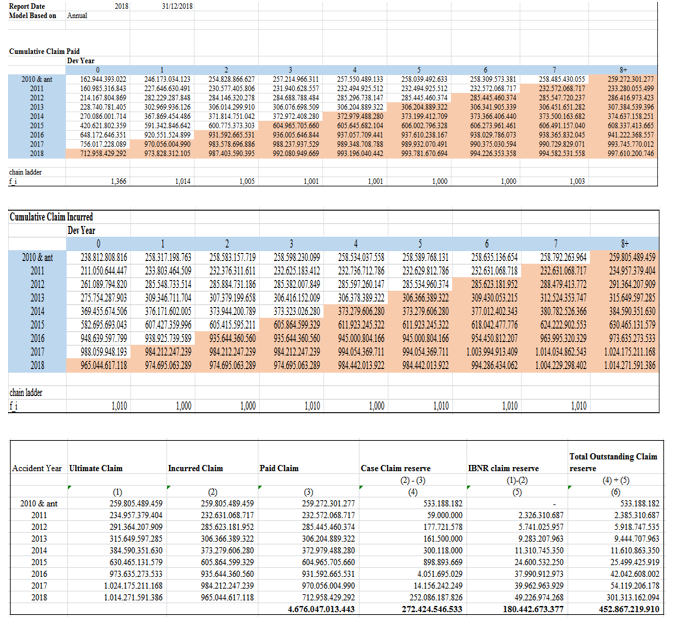

Sample of how IBNR Reporting works

We use our combined skills to develop leading edge solutions for our clients. We have access to our network of financial experts and strategic partner. Our scope of services includes:

- Risk Based Capital (RBC)

We shall eagerly engage with insurers & banks in their transformation journey, which includes:

- Implementation of RBC risk capital charges in both asset and liability modules.

- Projection of RBC for Embedded Value (EV) calculation, taking into account investment strategy and embedded asset risks.

- Reduction on RBC projection run time through advanced coding techniques.

- Identifying opportunities to improve capital adequacy ratio (CAR).

- Solvency II and Economic Capital

- Building a Solvency II model platform to resemble asset, investment strategy, and dynamic decision functionalities.

- Incorporating stochastic functionalities to quantify the embedded guarantees and options on a market consistent approach.

- Developing risk shock functionalities in the model to quantify Solvency II Solvency Capital Requirement (SCR) and risk margin.

- Leveraging existing Economic Capital platform to develop Solvency II internal model.

- Assisting clients with their Solvency II Quantative Impact Study (QIS).

YOUR RISKS, WE PROTECT

Interested in how we can help you?